June 29th was a momentous day for Tesla and the future of the electric automotive industry. The IPO was priced way above initial expectations of $14-16 a share at $17. After some fluctuation, the stock was up 40% to $23.89/share. The market value was over $2 billion driving up founder Elon Musk's portfolio value tremendously. This on a day where the Dow fell 268. As an entrepreneur, this was a day that filled me with hope, because here was an entrepreneur that put his heart, soul and money into a company and won. However, the press was having nothing of it. The day before many of the news articles were fairly negative. Most of them went something like this Wall Street Journal article, "Tesla Motors: IPO Fueled by Glamor":

"So far the company has accumulated $290 million in total losses, on $148 million in sales. It expects net losses at least until 2012. Anyone betting on Tesla stock is gambling on the success of the forthcoming Model S. But Tesla itself warns that car "is at an early stage of development" and will not be in production until 2012. It adds that it has yet to finalize the design, or complete the engineering, manufacturing or component supply processes for the new car."

Many articles and comments said the same thing:-Tesla proof Wall Street still believes in fairy tales - Oakland Tribune

-Tesla IPO: False promises for clean tech - Fortune

However, the investor community had a different response. The positive energy was palpable. The Position2 Brand Monitor graph on Tesla shows the massive spike and positive sentiment differential.

The number of posts (tweets, news articles and blog posts) on the company exploded to over 2,700 today from an average of 25-30/day. There was a 4:1 difference in positive vs. negative sentiment. While much of it positivity in the sentiment algorithm related to the increase in share price, there were tweets and posts like this:

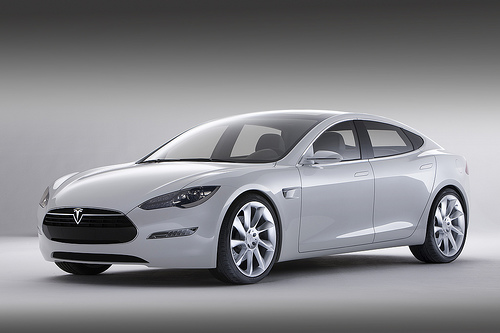

- The Future of Luxury - Tesla Model S http://tinyurl.com/2flua9l beautiful design, 0 emissions, nearly affordable - @ThomasOhhh

- Something else that helped Tesla was having major strategic investments from Daimler Chrysler and a commitment from Toyota - WSJ Blog

An Entrepreneur's Take...

As an entrepreneur and technology geek, I find the IPO to be heartening. Elon Musk, successful PayPal founder, is a longtime entrepreneur who bet it all to bring Tesla to market. Previously, electric cars were considered doudy - for the granola set. They suffered from high costs, poor driving performance, long charge times and short driving range. The conventional thinking was that a car would have to be available for the masses first, so companies tried to shoehorn a high cost vehicle into a mass market or weird platform (GM EV1). Tesla, by contrast, utilized the typical technology lifecycle model. Original founders, Martin Eberhard and Marc Tarpenning understood that expensive technology needs to be sold to a premium market to move down the learning curve of product development and manufacturing efficiencies. So they built a sexy sports car on the Lotus platform that took advantage of the high torque range of electric motors, the low cost of electric car operation, strong lightweight materials like carbon fiber and a unique powertrain that gave a first-of-its-kind 200+ mile range.

While there are many sides of the Elon Musk story, he focused on building a great car. He focused on high quality materials, production quality and service. He did not compromise in creating a great brand experience from vehicle to showroom to post-purchase service. At the previous TiEcon, I remember my when Musk drove into the room with the Tesla Roadster. The car was stunning. Even more inspiring to me was that Musk was willing to bet it all to make Tesla and SpaceX successful.

The Model S has the potential to reach a wider market than the Roadster. With federal stimulus loan money for the factory and powertrain facility, Silicon Valley now has a new technology development and manufacturing opportunity.

There is more to the car than the actual vehicle. There is the technology behind it. There's an electric powertrain that has the interest of Daimler-Benz and Toyota. There's all the experience that Tesla has gone through to build the vehicle. All of these technologies have value beyond the economics of building a vehicle. Like Amazon's Z shops, the licensing of electric motor, battery and powertrain technology can provide a tremendous margin boost to the company.

It's my hope that the desolate winter of new IPOs is ending. Up until recently, the only way to get an exit event was to be acquired. This reduced valuations for entrepreneurs and made start-up investment more difficult because of the increased uncertainty. While risk adjusted rewards are still not entrepreneur-friedly, IPOs like Tesla, OpenTable and ReachLocal move the needle in the right direction.

So let's celebrate Tesla, Musk and his team. Let's hope the stock rises in value so that VantagePoint Partners and other investors can see a significant return. We want them to cycle their money into new innovative start-ups. We should want them to be the next Google. If Silicon Valley and America wants to lead the way in new job-creating, game-changing innovation, we want companies like Tesla to succeed.